Despite the unprecedented drop in global air traffic due to the Covid-19 crisis in the past years, passenger numbers and cargo volumes are anticipated to increase in the coming decades. The International Civil Aviation (ICAO) has updated its growth forecast for global air passenger numbers post-Covid using three scenarios (low growth is 2.9%, medium is 3.6%, and high is 4.2% per annum). At the same time, aircraft and operational efficiency are expected to improve by 1.8-2.0% per annum.

Greenhouse gas (GHG) emissions from aviation contribute to 2% of total GHG emissions, with just over 600 Mt of carbon dioxide (CO₂) production in 2020. The ICAO has set ambitious goals to reduce aviation net CO₂ emissions by 50% by 2050, compared to 2005 levels.

In addition, in 2021, the global air transport industry, through the ATAG (Air Transport Action Group), adopted a long-term climate goal of net-zero carbon emissions by 2050, confirming the commitment of the world’s airlines, airports, air traffic management, and the makers of aircraft and engines to reduce CO₂ emissions in support of the Paris Agreement 1.5ºC objective.

While a range of technical, operational, and behavioural solutions are required to reduce aviation emissions, it is recognised that liquid fuels will continue to be the dominant fuel for air travel through to 2050.

What is SAF, its market perspectives, and how to produce it?

SAF is an alternative to fossil jet fuel and a promising solution to decarbonize the aviation sector.

It is produced from either:

- Renewable or waste-derived bio-based resources that meet sustainability criteria depending on the source, such as renewables oils and fats, lignocellulosic biomass, wastes, low C-I inedible starches, and sugars

- Captured CO₂ combined with green hydrogen (produced via the electrolysis of water using electricity from renewable sources – so-called e-kerosene)

SAF is a drop-in fuel, meaning it can be blended with traditional jet kerosene (currently up to 50 vol%), and the blend does not require equipment change, special infrastructure, or modification of the supply chain, therefore limiting supply-chain investment requirements.

According to the IEA, SAF currently accounts for 0.1% of global jet fuel consumption.

The primary drivers for future SAF market development are listed below, resulting from the basic realisation that producing SAF is currently more expensive than producing fossil-based jet fuel. A combination of consumer pricing, regulatory, and incentive programmes is therefore required to expand SAF production, regardless of the pathway.

Regulations

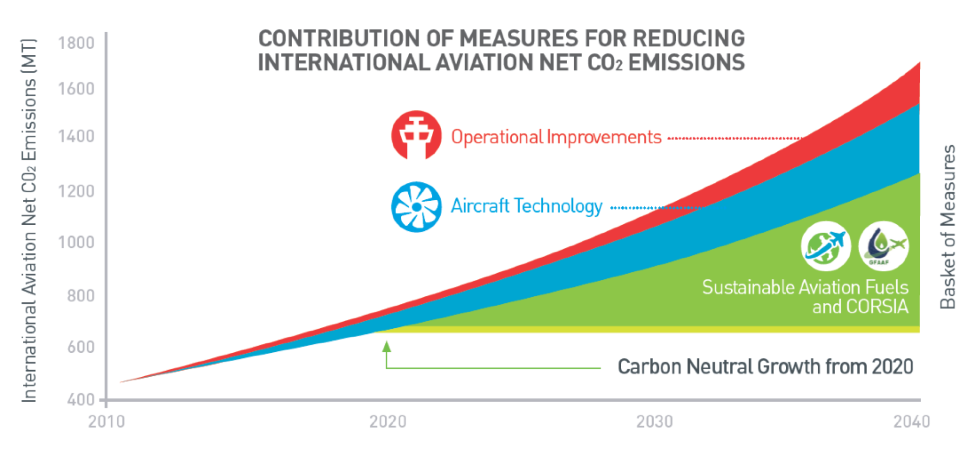

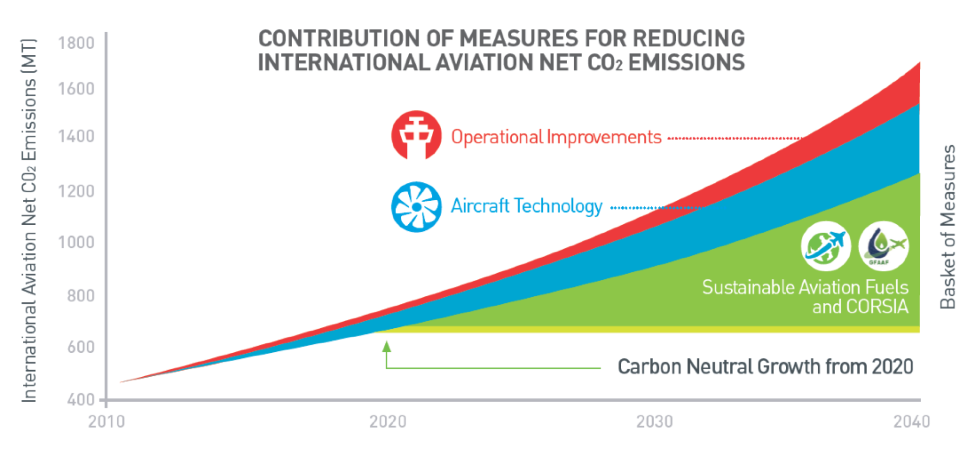

- World: in 2016, the ICAO adopted a global market-based mechanism, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), to address CO₂ emissions from international aviation. This programme aims to freeze aviation CO₂ emissions at 2020’s level via three actions: increasing airframe and engine efficiency, improving operations efficiency, and expanding the use of biofuels (SAF).

Figure 1. Contribution of measures for reducing international aviation net CO₂ emissions (ref CORSIA)

- Europe: In 2021, under the Fit for 55 initiative, EU regulations defined a road map and mandates for SAF, which are also agreed by the ATAG: from 2% in 2025, 5% by 2030, all the way up to 63% in 2050. According to the ATAG, it is likely that the aviation sector will need around 450-500 million tons of SAF per year by 2050. Europe regulations are promoting advanced biofuels or those derived from feedstocks not in direct or indirect competition with food resources.

- US: Many US fuel purchasers are considering carbon-intensity-based metrics to evaluate fuel sustainability, utilising tools like the GREET model developed by Argonne National Lab. Such models do not group feedstocks or processes by category, but instead scientifically calculate a given feed’s overall GHG emission profile considering its feedstock production, transportation, processing, and utilisation. The resulting scientifically based, quantified Carbon Intensity (CI) score can then be utilised to both (1) determine the sustainability of a given fuel compared to fossil baselines and (2) provide

regulatory and credit structures that incentivise CI reductions across the entire SAF value chain.

Market price

- Consumers may also play a role in growing SAF production. Programmes exist today from many of the major carriers, allowing private passengers to pay a ticket premium that is then transferred down through the airline procurement chain to ensure SAF blending.

- On the corporate level, major organisations are now actively trading air travel emission credits and maturing dialogues with their air transportation partners to formulate actionable, mid- and long-term SAF strategies driven by an increasing societal demand, which, when combined with the lack of SAF production, has led to SAF prices in excess of 3000$/t FOB Rotterdam in early 2022.

Project development support

Major corporate organisations are in some cases partnering with airlines and migrating upstream in the SAF supply chain to inject capital, offtake commitments, and other support directly at the project-development level, helping to reduce risk, offset project development costs, and catalyse SAF supply market growth.